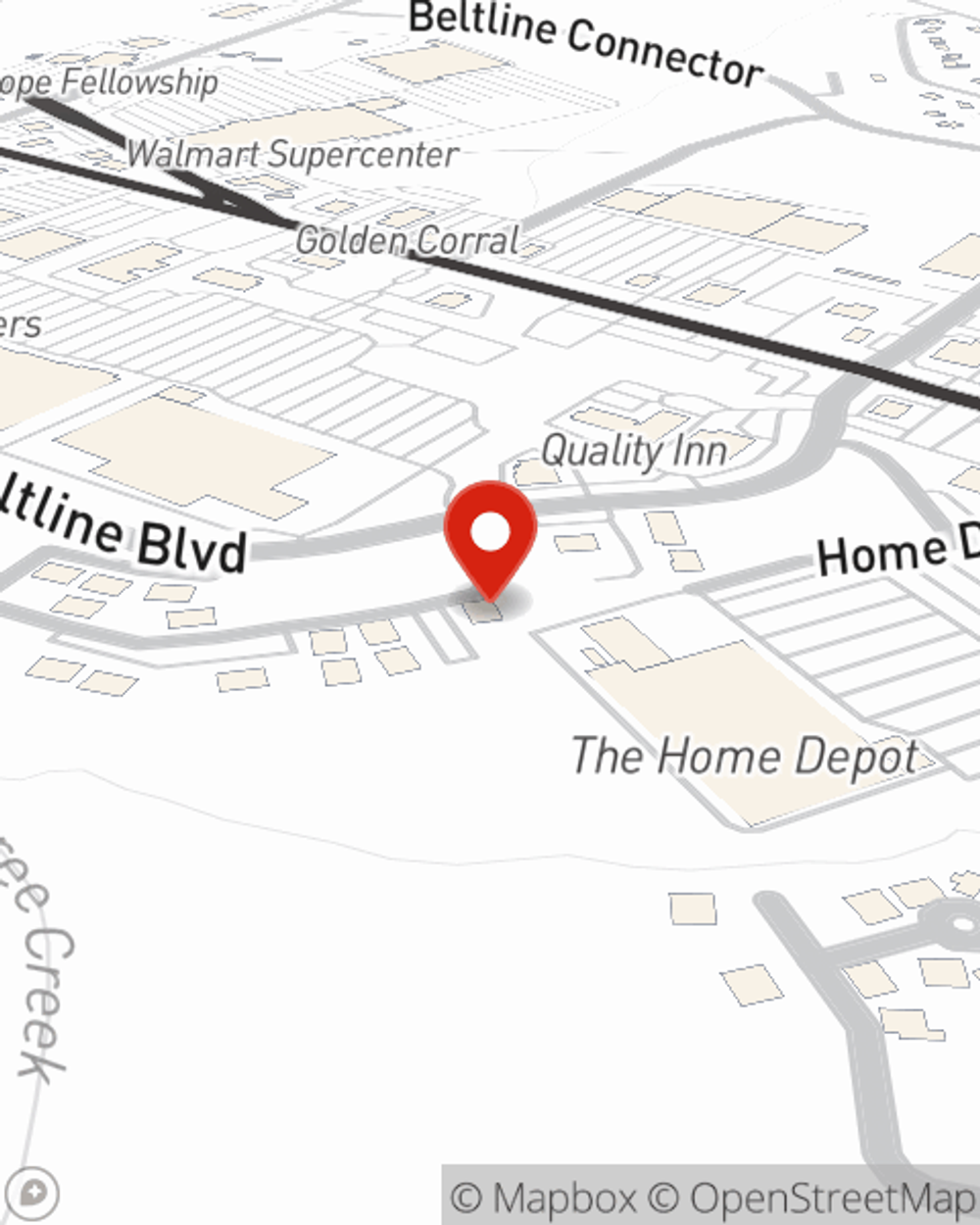

Business Insurance in and around Anderson

Get your Anderson business covered, right here!

Cover all the bases for your small business

This Coverage Is Worth It.

When experiencing the highs and lows of small business ownership, let State Farm be there for you and help provide great insurance for your business. Your policy can include options such as errors and omissions liability, a surety or fidelity bond, and worker's compensation for your employees.

Get your Anderson business covered, right here!

Cover all the bases for your small business

Insurance Designed For Small Business

At State Farm, apply for the great coverage you may need for your business, whether it's an art school, a florist or a lawn care service business. Agent Parker Smith is also a business owner and understands what you need. Not only that, but personalized insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

Call Parker Smith today, and let's get down to business.

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Parker Smith

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".